Tax compliance is a very important issue for Infor LN customers. Many are discovering that using the internal LN tax functionality does not ensure full compliance with all USA state and local regulations and provisions. As a result, these companies find themselves exposed to potentially expensive penalties imposed by the tax authorities due to failed audits. Moreover, even if compliance can be achieved using internal LN tax functionality, companies find that this is a tedious, inefficient, labor intensive and expensive process that does not make the best use of their finance department resources. The tax compliance landscape in the USA is difficult to navigate due to the myriad confusing and ever-changing rules with which companies are expected to comply. This situation is further complicated by the existence of tax exemptions. Companies are expected to be aware of and manage tax exemptions for all their customers.

External tax providers provide a solution to this issue. A Tax Provider supplies cloud-based or on-premise software to execute tax determination for transactions. The software is updated on a regular basis to ensure that it is compliant with all IRS requirements so that companies can be confident that tax is being assessed correctly. This software will also correctly manage and apply tax exemptions where necessary. Additionally, some tax providers will handle all necessary tax filing with the various tax authorities. This removes a huge resource drain on the in-house finance department.

Unfortunately, Infor LN does not have native integration with external Tax Provider software apart from Vertex and Avatax (only LN versions 10.6+). Customers who use tax provider software other than Vertex cannot leverage their tax software of choice to handle their Infor LN tax compliance issues.

The Solution

Disus has created tax connector software to provide a direct, native integration between Infor LN and several tax providers. This tax connector allows companies to leverage their tax provider of choice to handle tax compliance within Infor LN. The tax connector integration supports the following tax provider software:

- Avatax by Avalara

- Taxware Enterprise by Sovos

- ONESOURCE by Thomson Reuters

- Other tax providers upon request as a bespoke project

Disus has engineered the connector for maximum compatibility with all Infor LN tax transactions:

- It interfaces with the standard Infor LN Tax API and thus supports all tax transactions that occur in the Infor LN software.

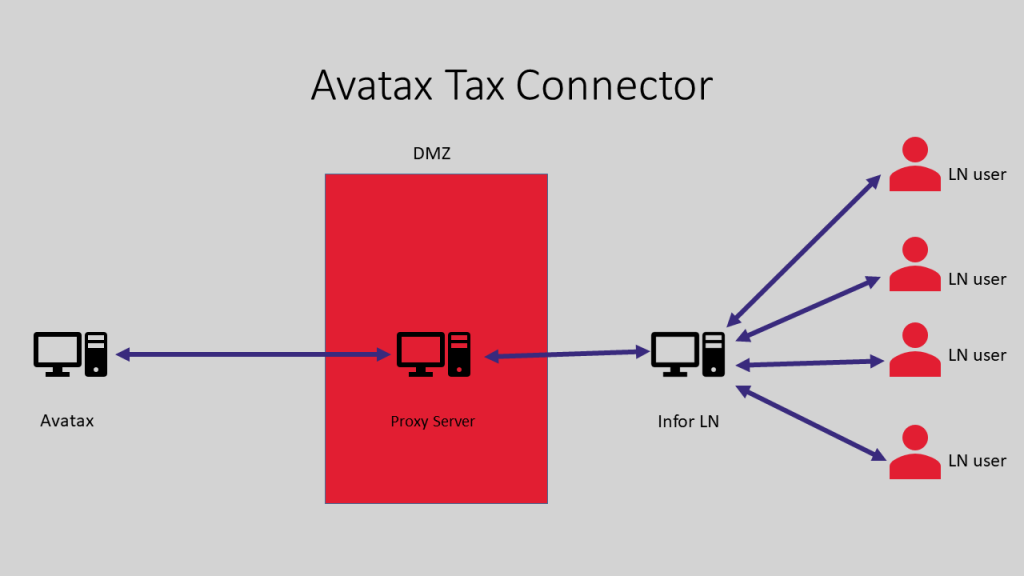

- Built with 100% native Infor LN tools code. No external software is required. Note that Avatax connector is an exception to this. There is a small Windows proxy client needed to enable corporate firewall traversal.

- Support for all Infor LN releases since FP3, including all 10.x releases (Infor LN porting set upgrade may be required). Note that Infor LN supports Avatax from LN 10.6 onwards and thus the Disus Avatax connector is not applicable for versions beyond 10.6)

- Every client has unique needs and the connector can be customized for any implementation specific tax scenarios.

What about Baan IV?

Disus does not have a tax connector for Baan IV. However, we are happy to entertain requests to build a connector as a custom project for any customers that request it.

Explore our Software

Disus software components streamline ERP processes and sessions, add user-friendly functionality such as mobile applications, and simplify the use and integration of third party products.